The pandemic has transformed various sectors digitally, including banking, to meet the demands of modern customers.

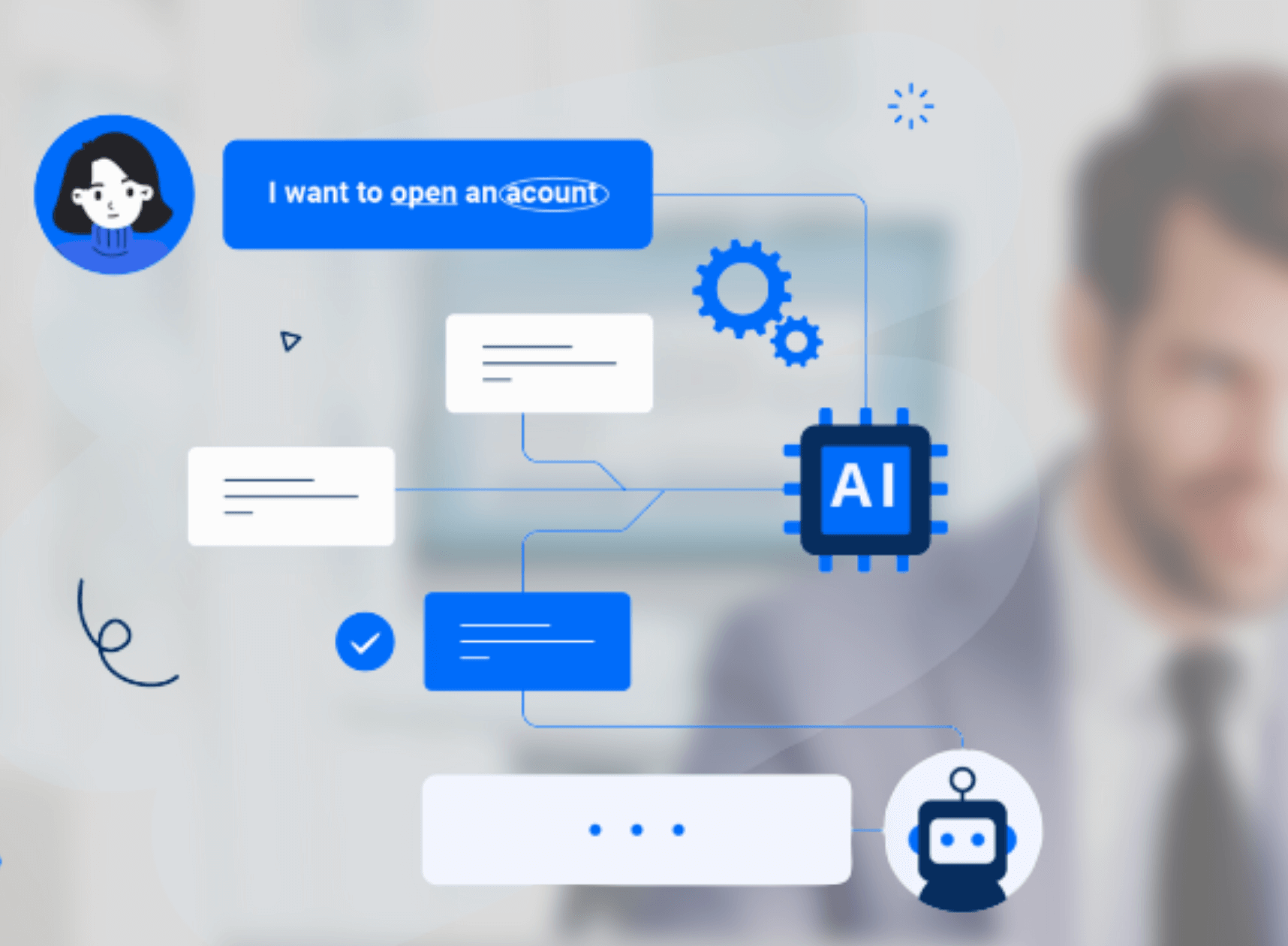

Artificial intelligence and machine learning are slowly engulfing the banking and finance sector. For Instance, a banking chatbot has enormous potential in terms of customer engagement. As a result, a chatbot is the most popular technology, whether an emerging startup or a large enterprise.

The key here is to provide a seamless and personalised customer experience while saving money. This article will explain how a chatbot in banking is remarkable for conducting banking operations.

The Significance of Bots in the Banking Sector

Chatbots have come a long way as technology has advanced. A banking chatbot is available to provide exceptional customer service round-the-clock without forgetting anything.

Let’s look at some of the benefits AI-powered banking bots can provide:

Fast-Paced Communication

The chatbots use Natural Language Processing (NLP) to analyse the customers’ needs and provide 24×7 support. It also aids in giving personalised interactions. As a result, it has access to information with pleasant interactions and speed. Finally, and most importantly, chatbots eliminate human error because they provide accurate answers.

Transactional

Chatbots can also manage essential operations and respond to queries such as “Please transfer XXX to Michael”. Here the assistant helps facilitate the operations by coordinating with the backend operations. Conversational AI best serves businesses by integrating with internal and external systems. As a result, the bot must exhibit two critical characteristics: dependability and security.

Security

The chatbots make the customer’s banking process simplified by reducing the mistakes made by humans. Furthermore, it keeps the data safe with more privacy and protection related to the user’s banking information. Thus, it gives the customers peace of mind as businesses integrate their chatbot solution with a centralised authentication system.

Cost Effective

The banking bots are cost-effective because they save operational costs and offer 24×7 support which a human agent cannot provide. In addition, it aids in developing end-to-end business processes that result in a better customer and client experience. Further, it can handle multiple chats altogether and significantly boosts the ROI.

Enhanced Productivity

Chatbots provide critical assistance and information to improve performance and productivity. In banking, to prevent fraudulent transactions, it is vital to reach out to a banking bot to streamline the process. In addition, it helps customers with urgent issues related to checking statements or completing transfers.

Develop AI-powered Banking Bots with Mtalkz!

Banking bots are quickly becoming the preferred customer service platform. It benefits financial service providers because it allows for two-way communication with machines via natural language commands.

For contextual conversation and a seamless experience, a banking chatbot is the preferred customer support platform. A conversational ai chatbot in banking is highly adaptable and can be used in various customer interactions.

Mtalkz assists businesses in expanding their support to new and emerging platforms to reach their customers where they are. As a result, effectively meeting expanding consumer needs modernises client-facing services and accelerates corporate growth.