| Product Name | 1,4-Dimethylbenzene |

| Chemical Formula | C8H10 |

| Synonyms | Para-Xylene, 106-42-3, 1,4-Xylene, p-Methyltoluene, p-Dimethylbenzene |

|

Region/Countries for which Data is available |

|

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | Our services can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after service delivery |

Request for Real Time 1,4-Dimethylbenzene Prices: https://www.procurementresource.com/resource-center/1-4-dimethylbenzene-price-trends/pricerequest

1,4-Dimethylbenzene is a hydrocarbon with a distinct aromatic smell. It is a xylene isomer based on benzene and two methyl substituents. The commodity’s polymer derivative is called Parylene.

The compound is made by the process of catalytic reforming of naptha. It is split during the various distillations, absorption, or crystallization, as well as reactions from m-xylene, o-xylene, and ethylbenzene.

1,4-dimethylbenzene is the most commonly used dimethylbenzene. Benzene-1,4-dicarboxylic acid (terephthalic acid) is the result of oxidising 1,4-dimethylbenzene, which is then reacted with ethane-1,2-diol (ethylene glycol) in order to get the monomer that is used for polyster and polyethylene terephthalate (PET).

The worldwide leading 1,4-Dimethylbenzene producing countries are South Korea, India, Japan, Saudi Arabia, and Brunei.

Key Details About the 1,4-Dimethylbenzene Price Trend:

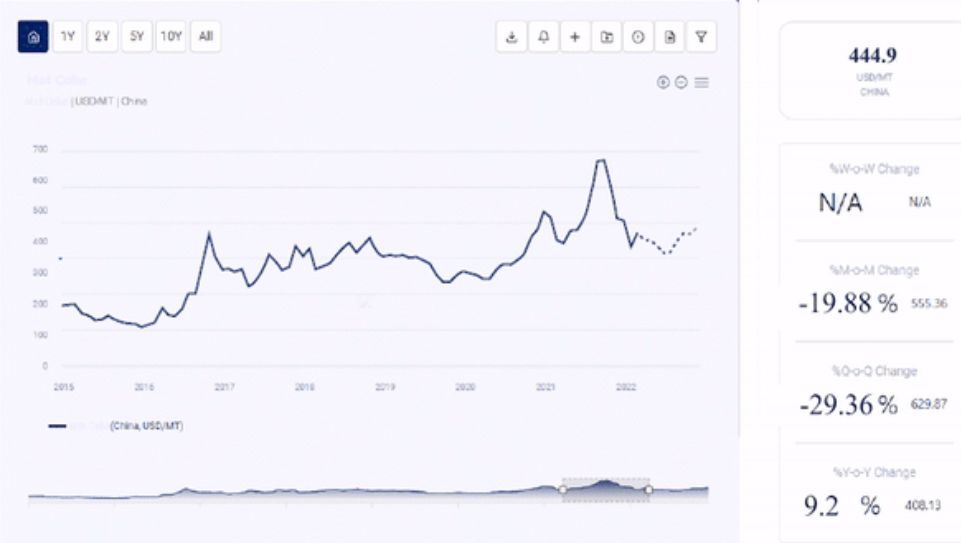

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the 1,4-Dimethylbenzene price in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as excel files that can be used offline.

The 1,4-Dimethylbenzene price analysis, pricing database, and chart can prove valuable for the procurement managers, directors, and decision-makers to build up their strongly backed up strategic insights to attain progress and profitability in the business.

Industrial Uses Impacting 1,4-Dimethylbenzene Price Trend:

Industrial uses impacting 1,4-Dimethylbenzene price trend primarily include its application as an essential chemical feedstock. Furthermore, it is used as a raw material in the synthesis of several polymers in other industrial applications.

1,4-Dimethylbenzene performs a crucial part in the manufacturing of terephthalic acid, that is employed in manufacturing polyesters like polyethylene terephthalate (PET). It can also directly produce parylene by polymerisation.

Key Market Players:

- ENEOS Corporation

- Reliance Industries Limited

- S-OIL Corporation

- China National Petroleum Corporation

News and Events:

- Jan 17, 2021 – ONGC, a state-run oil and gas explorer, planned to finalise the merger of its refining subsidiary MRPL as the currently bought HPCL is set to align its downstream and upstream operations into two verticals which are facing a setback.

MRPL’s sub-division OMPL is a combined venture by ONGC and MRPL started for the value addition of extra aromatic streams and naphtha available from the MRPL refinery. This is Asia’s largest single stream capacity unit, producing 283 KTPA Benzene and 914 KTPA Para-xylene (1,4-Dimethylbenzene).

Related Reports

- Ethylbenzene Price Trend – https://www.procurementresource.com/resource-center/ethylbenzene-price-trends

- Aminobenzene Price Trend – https://www.procurementresource.com/resource-center/aminobenzene-price-trends

- Benzene Price Trend – https://www.procurementresource.com/resource-center/benzene-price-trends

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team track the prices and production costs of a wide variety of goods and commodities, hence, providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Christeen Johnson

Email: sales@procurementresource.com

Toll Free Number: USA & Canada: +1-415-325-5166 | Europe & Africa: +44-702-402-5790 | APAC: +91-8586081494

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Blog: https://procurementresource.blogspot.com/

Website: https://www.procurementresource.com/